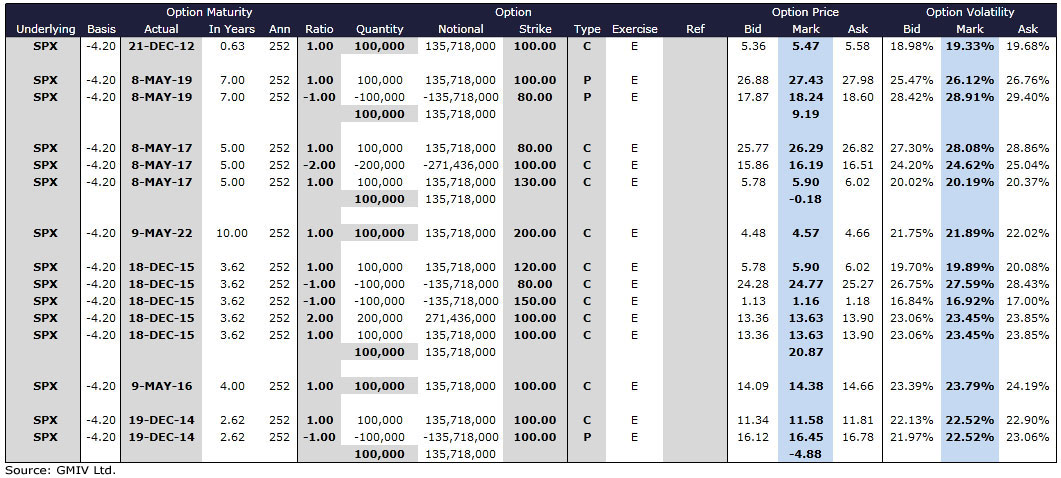

Options Pricer

With GMiPrice, get an accurate and live valuation of options structures such as OTC puts and calls, spreads, butterflies, etc. GMiPrice is easy to use - specify the underlying, maturity, strike and type of the option and the fair value of each position is calculated and displayed. The option implied volatility as marked on GMIV's implied volatility surface as well as the dividend yield that is used to price the option are also shown.

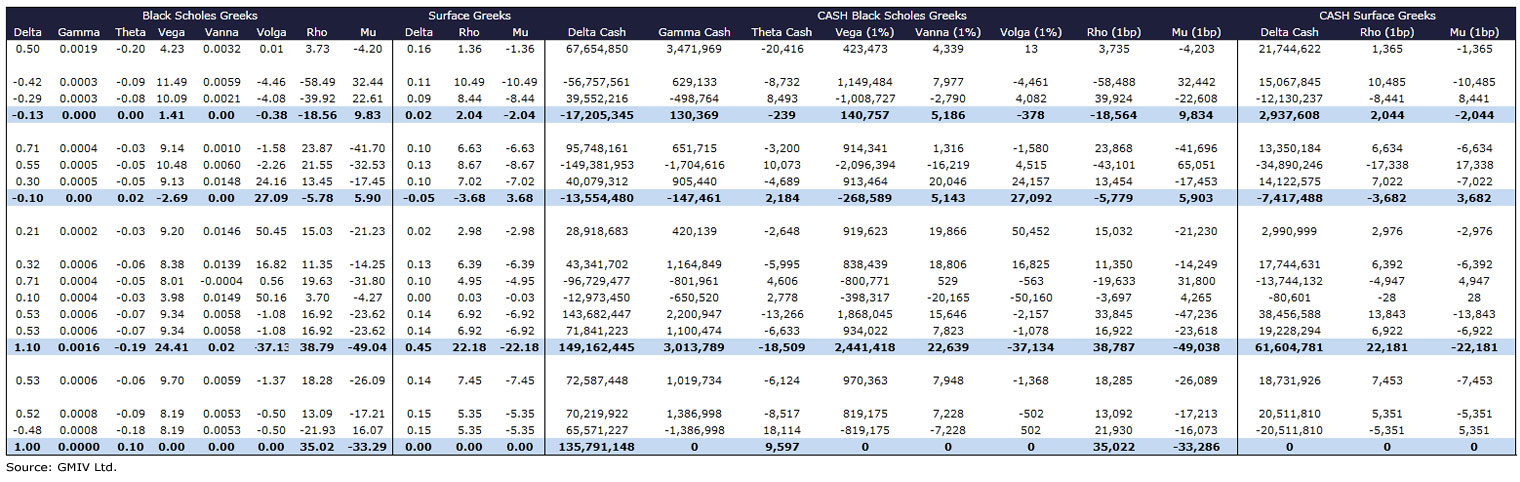

Risk Analysis

Risk management is key to successful trading. GMiPrice displays a detailed risk analysis for each position. We show the classic Black-Scholes sensitivities (or option Greeks) such as Delta, Gamma, Theta, Vega, Rho and Mu. We also indicate the Vanna and Volga of the option - the sensitivities of Vega relative to a move in spot and volatility. The equivalent dollar exposure of each risk parameter, i.e. the dollar Greeks, are also displayed.

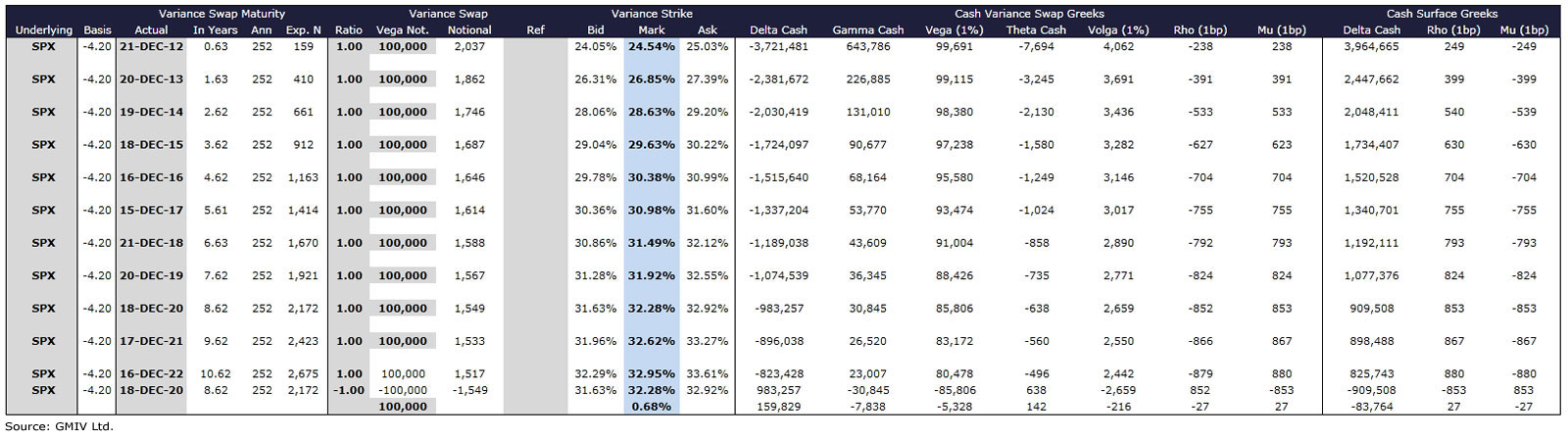

Variance Swap Pricer

Volatility has become an asset class to itself. It is a useful hedge against disaster scenarios and is also used for correlation trades, volatility-arbitrage strategies and credit vs. volatility trades. A variance swap is the most straightforward and liquid instrument to trade volatility. With GMiPrice users can value variance swaps, variance swap spreads and forward start variance swaps like the largest market participants on Wall Street.

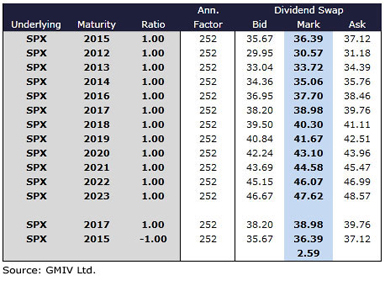

Dividend Swap Pricer

Dividend swaps are an efficient and easy way to express a view on a stream of future dividend payments of an underlying. They initially emerged from the need of banks to manage their risk in structured products. Today, they have become increasingly popular for investors looking to get a pure exposure to dividends and also for those looking to bet on economic trends, inflation, etc. The dividend swap pricer in GMiPrice gives users the possibility to obtain an accurate and live estimation of dividend swap levels for maturities up to 20 years.