GMiHedge.

Managing a derivatives book calls for strict and efficient risk management. GMiHedge meets these requirements by equipping users with a powerful and unrivalled risk management tool. With GMiHedge our clients will have a full grasp of GMiCost, our proprietary model for the construction of highly accurate implied volatility surfaces.

Key Benefits

- Powerful and efficient risk management tool

- Breakdown of a position into basic risks

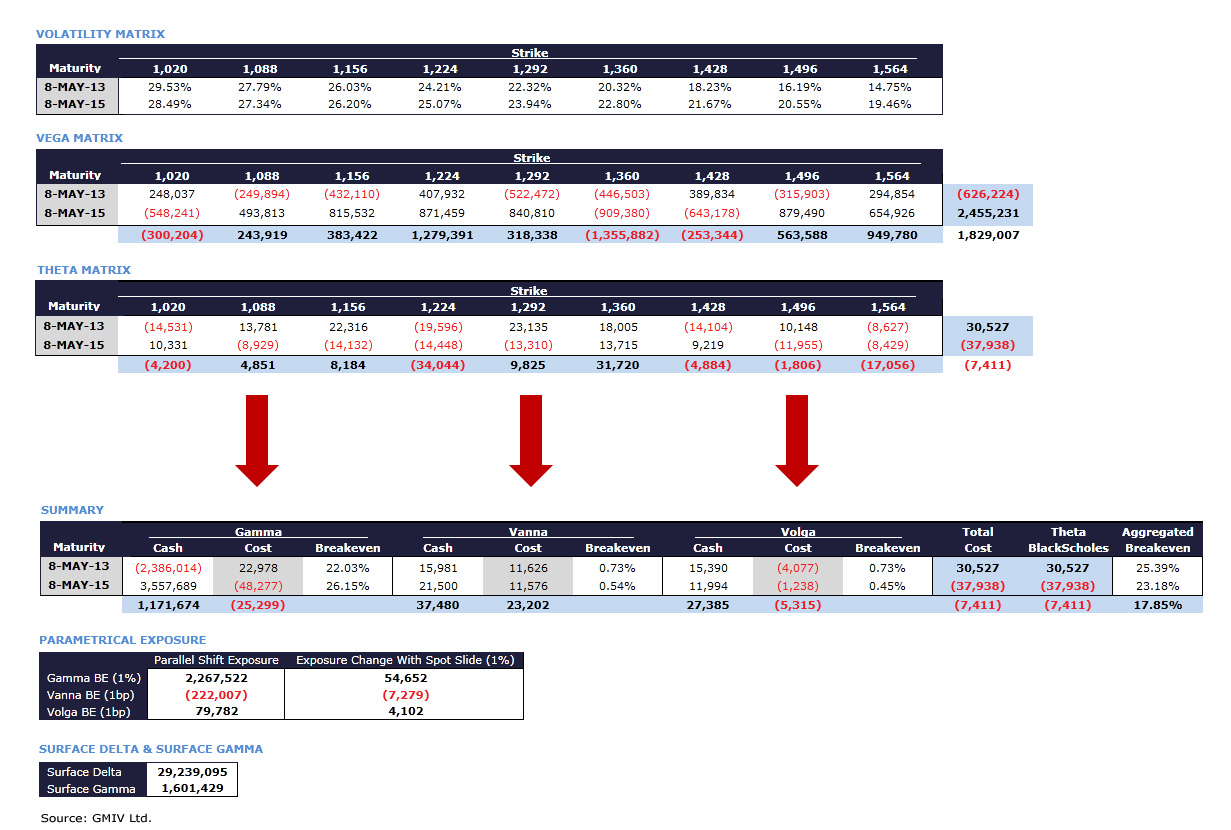

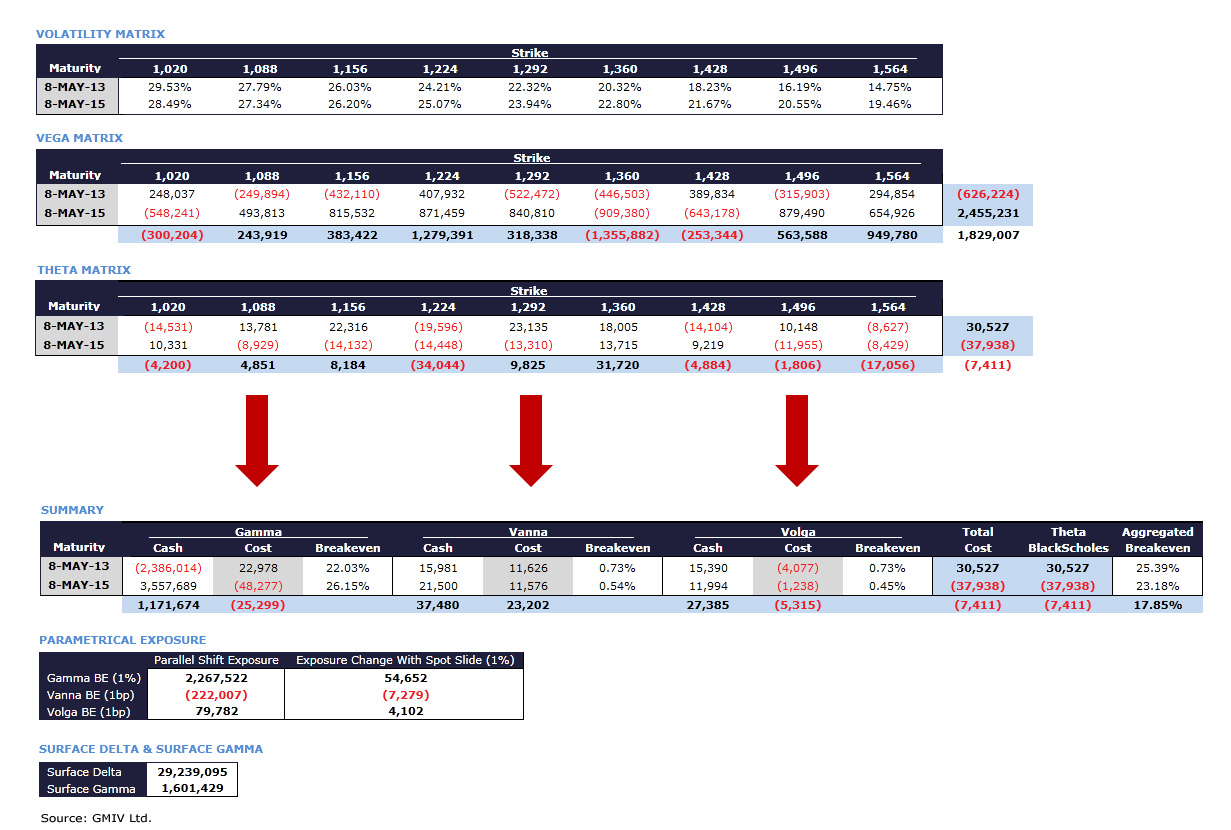

- Projection of overall carry onto an orthogonal space of carries: cost of carry of skew (Vanna), cost of carry of convexity (Volga) and cost of carry of volatility (Gamma)

- Catered to risk management department and trading desk

Risk Analysis of a Book

- The risk profile with spot slides / volatility changes (delta change)

- The surface delta

- The parametrical exposure to GMiCost

- A breakdown of the position into basic risks

- A projection of the overall carry onto an orthogonal space of carries